Final Expense Insurance

What Is Final Expense (Burial) Insurance?

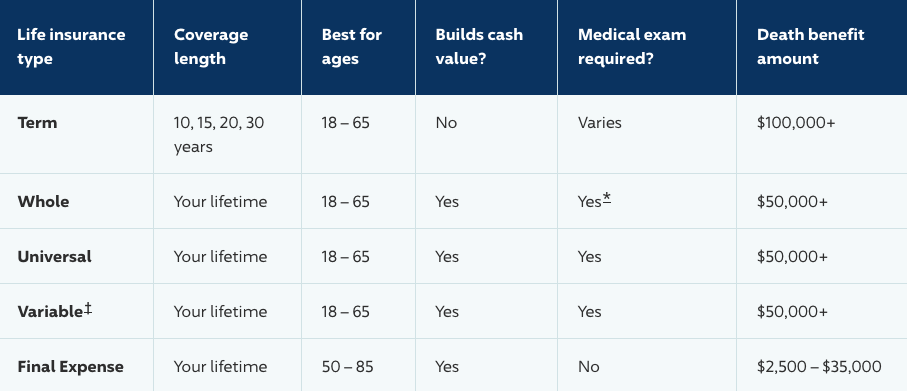

Final expense insurance is a small whole life insurance policy that’s meant to cover your funeral and burial costs, as well as other end-of-life expenses like medical and legal bills.

Also known as burial insurance, these policies are typically open to people 50 and older and capped at low coverage amounts. They usually start at $1,000 and max out at $25,000, though some insurers sell policies with a higher death benefit.

How Final Expense Insurance WOrk?

There are two main types of policies to choose from, and the application process is slightly different:

Simplified issue policies skip the life insurance medical exam, but you’ll have to answer questions about your health and lifestyle.

Guaranteed issue life insurance offers coverage without an exam or questionnaire.

CALL 866-780-8874

A Type of Whole Life Insurance, Final Expense Insurance

Also known as funeral or burial insurance, final expense insurance is a type of whole life insurance that offers a smaller and more affordable death benefit designed to help cover your end-of-life expenses like funeral costs, medical bills, or outstanding debt. While other types of life insurance may have age and health requirements, final expense policies can be easier for older or less-healthy individuals to qualify for. A final expense policy's cash value operates the same as a whole life policy's, building value at a fixed rate over time.

The Insurance Company Standard

We look for only the top-rated and financially stable Life Insurance Companies in our portfolio of carriers offering different types of Insurance.

The Brokerage Service Standard

Our business model allows us to shop multiple insurance providers without any additional costs to you. Review all comprehensive options.